The ETF (Nasdaq symbol QQQ buy or sell through brokers called the PowerShares QQQ ETF, holds stocks that represent the Nasdaq 100 Index. INVESCO QQQ ETF is a buy for aggressive investors. The fund’s top holdings for unitholders are UnitedHealth Group, Goldman Sachs, Home Depot, Boeing Company, Amgen, Microsoft, Caterpillar, McDonald ’s Corp., Honeywell,, and Visa Inc. Your MER for the SPDR Dow Jones Industrial Average ETF is a low 0.16% it offers investors a yield of 2.0%. The ETF began trading on January 14, 1998. The ETF (New York symbol DIA buy or sell through brokers you tap the 30 stocks that make up the Dow Jones Industrial Average. SPDR DOW JONES INDUSTRIAL AVERAGE ETF is a buy. You’ll pay about a third as much in management fees, while holding essentially the same stocks. If you want to own Canadian index exchange-traded funds (ETFs), you should buy the iShares S&P/TSX 60 Index ETF (see page 4). The ETF’s top holdings are Royal Bank, Shopify, TD Bank, Bank of Nova Scotia, CN Rail, Enbridge, Bank of Montreal, Brookfield Asset Management, CP Rail, CIBC, TC Energy, and Manulife. It began trading for investors on March 12, 1996.

The fund has a 0.51% MER and gives you a yield of 1.7%. The ETF (New York symbol EWC buy or sell through brokers ca.) holds the stocks in the Morgan Stanley Capital International Canada Index. ISHARES MSCI CANADA INDEX FUND is a sell in favour of a cheaper alternative. The highest-weighted stocks for investors in the SPDR S&P 500 ETF are Apple, Microsoft,, Alphabet, Facebook, Tesla, Berkshire Hathaway, JPMorgan Cha, Johnson & Johnson, Visa, UnitedHealthGroup, Walt Disney, Procter & Gamble, Nvidia, Home Depot, and Mastercard Inc. The fund’s MER is a very low 0.09% it yields 1.5%. The ETF began trading on January 22, 1993. companies based on their market cap, liquidity and industry group. ETF (New York symbol SPY buy or sell through brokers investors exposure to the stocks in the S&P 500 Index they are 500 major U.S. The fund’s top holdings are CIBC, Canadian Tire, Bank of Montreal, Royal Bank, Labrador Iron Ore, Scotiabank, TC Energy, BCE, and TD. That means this ETF is more actively managed than, say, the iShares S&P/TSX 60 Index ETF. However, the iShares Canadian Select Dividend Index ETF focuses on the 30 stocks that it sees as having the highest dividend yields it also considers their prospects for dividend growth and sustainability for investors. Most market-index exchange-traded funds ( ETFs) are set up for investors so that the stocks in the index are those with the highest market capitalization and are also the most widely traded. The ETF, which began trading on September 28, 1999, yields a high 4.1%. The weight of any one stock holding is limited to 10% of the fund’s assets. The ETF also considers dividend growth and payout ratios to make its selections. The fund (Toronto symbol XDV buy or sell through brokers ca.) holds 30 of the highest-yield Canadian stocks. ISHARES CANADIAN SELECT DIVIDEND INDEX ETF is a buy. The quality of the ETF’s holdings should drive your future gains: its top stocks are Royal Bank, Shopify, TD Bank, CN Rail, Scotiabank, Enbridge, Brookfield Asset Management, Bank of Montreal, and CP Rail. However, it must ensure that all sectors are represented, so it holds a few companies we would not include.

The S&P/TSX 60 Index mostly consists of high-quality companies. The ETF began trading on September 28, 1999.

It focuses on the 60 largest, most heavily traded stocks on the exchange. Specifically, the fund ’s holdings represent the S&P/TSX 60 Index. The ETF (Toronto symbol XIU buy or sell through brokers ca.) is a good low-fee way for you to buy the top companies listed on the TSX.

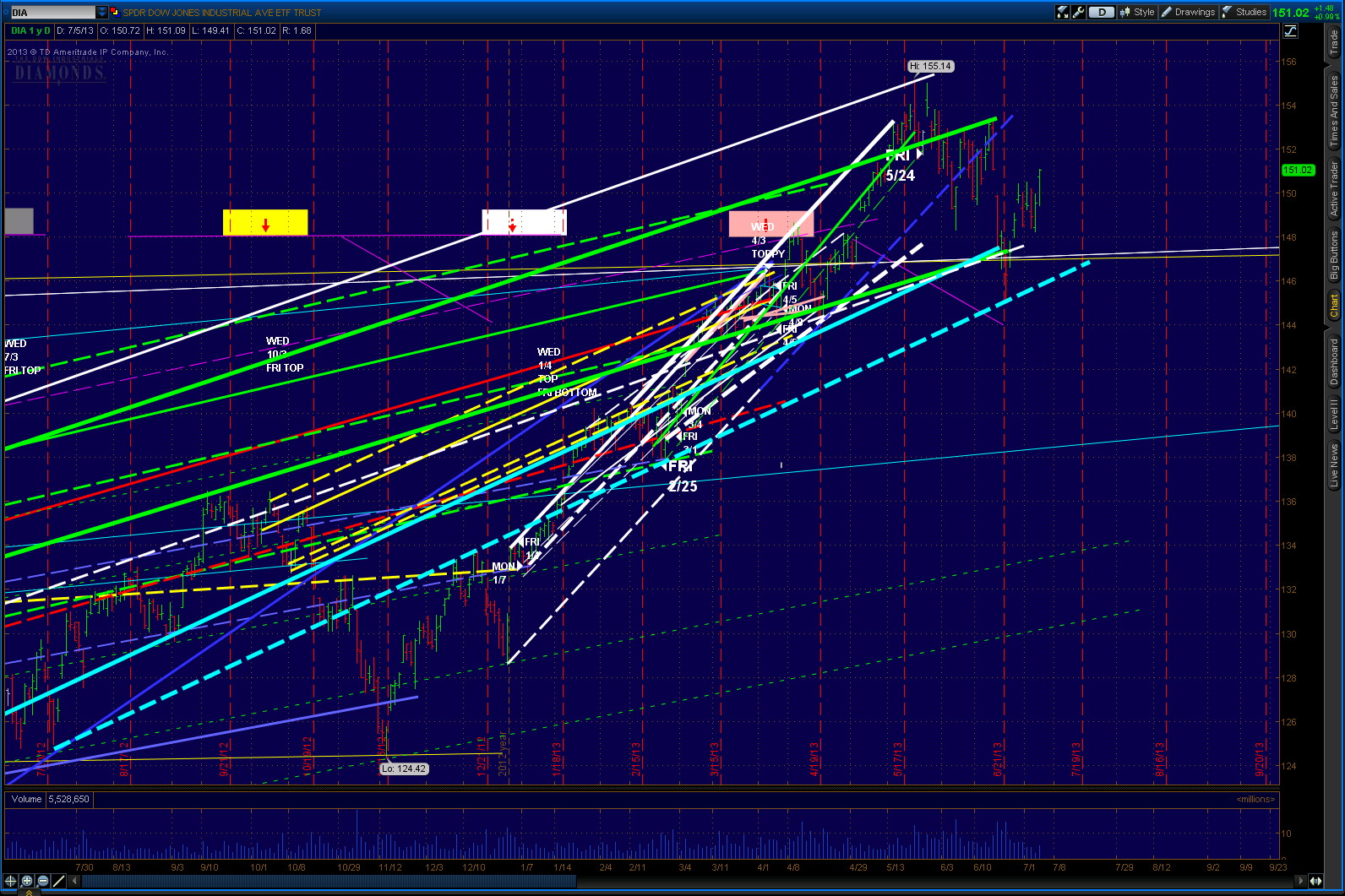

#DIA ETF COMPONENTS UPDATE#

But their low management fees give them a cost advantage over most mutual funds.īelow, we update our advice on all six exchange-traded funds (ETFs)-five buys and one we now see as a sell. Of course, you may pay brokerage commissions to buy and sell these ETFs. That’s different from narrower indexes that focus on resources or themes such as solar power or biotech. Each ETF mirrors, or tracks, the performance of a major stock market index. They’re widely traded on Canadian and U.S.

As a result of this low turnover, you won’t incur the regular capital-gains bills generated by the yearly distributions most conventional mutual funds pay out to unitholders.īelow are six exchange-traded funds (ETFs) that hold mostly blue-chip stocks. As well, shares are only added or removed when the underlying index changes.

0 kommentar(er)

0 kommentar(er)